Therefore, dividends play a vital role in communicating the strength and sustainability of a company to its shareholders, potential investors, and the market. For accounting purposes, dividends are a reduction in the retained earnings or profits of a company. The main source stock dividends are recorded at market value, while stock dividends are recorded at par value. of finance for companies, especially small-size companies and startups, is equity finance. Equity finance consists of finance that companies raise through their shareholders. In exchange for the finance they provide, shareholders receive the shares of the company.

Accounting for a Stock Split

The existence of a cumulative preferred stock dividend in arrears is information that must be disclosed in financial statements. Only dividends that have been formally declared by the board of directors are recorded as liabilities. If cumulative, a note to the financial statements should explain Wington’s obligation for any preferred stock dividends in arrears. To illustrate, assume that the Hurley Corporation has one million shares of authorized common stock. To date, three hundred thousand of these shares have been issued but twenty thousand shares were recently bought back as treasury stock.

Do you already work with a financial advisor?

Prior to the distribution, thecompany had 60,000 shares outstanding. The difference is the 3,000additional shares of the stock dividend distribution. The companystill has the same total value of assets, so its value does notchange at the time a stock distribution occurs. The increase in thenumber of outstanding shares does not dilute the value of theshares held by the existing shareholders. The market value of theoriginal shares plus the newly issued shares is the same as themarket value of the original shares before the stock dividend.

- The first of these are changes to the price of the security and various items tied to it.

- The difference is the 18,000 additional shares in the stock dividend distribution.

- Companies use stock dividends to convert their retained earnings to contributed capital.

- Stock investors are typically driven by two factors—a desire to earn income in the form of dividends and a desire to benefit from the growth in the value of their investment.

- The difference is the 3,000 additional shares of the stock dividend distribution.

What types of companies offer dividends?

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

You must cCreate an account to continue watching

A dividend is a portion of a company’s earnings that is paid to a shareholder. The most common type of dividend is a cash payout, but some companies will issue stock dividends. The board of directors of every company issues small stock dividends, although in some cases they are approved by shareholders at large. This happens most often when a company has more cash than it needs or when its stock is trading at a rather high price.

Accounting for Cash Dividends When Only Common Stock Is

On the other hand,stock dividends distribute additional shares of stock, and becausestock is part of equity and not an asset, stock dividends do notbecome liabilities when declared. Some companies issue shares of stock as a dividend rather than cash or property. This often occurs when the company has insufficient cash but wants to keep its investors happy. When a company issues a stock dividend, it distributes additional shares of stock to existing shareholders. These shareholders do not have to pay income taxes on stock dividends when they receive them; instead, they are taxed when the investor sells them in the future. A company’s board of directors has the power to formally vote to declare dividends.

Dividends Per Share

The stock dividend rewards shareholders without reducing the company’s cash balance. A stock dividend distributes shares so that after thedistribution, all stockholders have the exact same percentage ofownership that they held prior to the dividend. There are two typesof stock dividends—small stock dividends and large stock dividends.The key difference is that small dividends are recorded at marketvalue and large dividends are recorded at the stated or parvalue. A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend. There are two types of stock dividends—small stock dividends and large stock dividends. The key difference is that small dividends are recorded at market value and large dividends are recorded at the stated or par value.

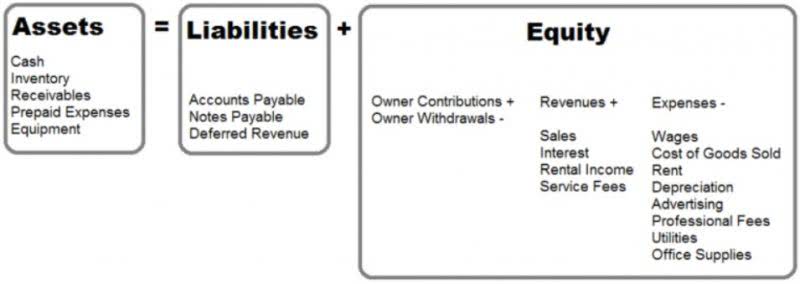

Accounting Equation Formula & Examples

They are a distribution of the net income of a company and are not a cost of business operations. The board of directors then declares and distributes a 4 percent stock dividend. For each one hundred shares that a stockholder possesses, Red Company issues an additional 4 shares (4 percent of one hundred).

In the case of a stock dividend, however, the amount removed from retained earnings is added to the equity account, common stock at par value, and brand new shares are issued to the shareholders. A stock split is much like a large stock dividend https://www.bookstime.com/ in that both are large enough to cause a change in the market price of the stock. Additionally, the split indicates that share value has been increasing, suggesting growth is likely to continue and result in further increase in demand and value.

How Often Are Dividends Distributed to Shareholders?

- The dividend yield is the dividend per share and is expressed as dividend/price as a percentage of a company’s share price, such as 2.5%.

- In the case of a cash dividend, the money is transferred to a liability account called dividends payable.

- The required rate of return is determined by an individual investor or analyst based on a chosen investment strategy.

- The market may perceive a stock dividend as a shortage of cash, signaling financial problems.

“Money for Nothing” is not only the title of a song by the band Dire Straits from the 1980s, but it is also the feeling many investors get when they receive a dividend. All you have to do is buy shares in the right company, and you’ll receive some of its earnings. The journal entry to distribute the soft drinks on January 14 decreases both the Property Dividends Payable account (debit) and the Cash account (credit). She called the business Colossal Shears and even had a few good friends invest money to get the business up and running. Within a few months on the market, Colossal Shears became bestsellers. Barbara was glad that she could not only pay her bills but also give her investors a small return on their investments.…